variable life insurance face amount

It is intended to meet certain insurance needs investment goals and tax planning objectives. You can get up to a 150000 term policy lasting 10 to 30 years if youre under 70.

Hahaha Life Insurance For Seniors Life Insurance Quotes Term Life

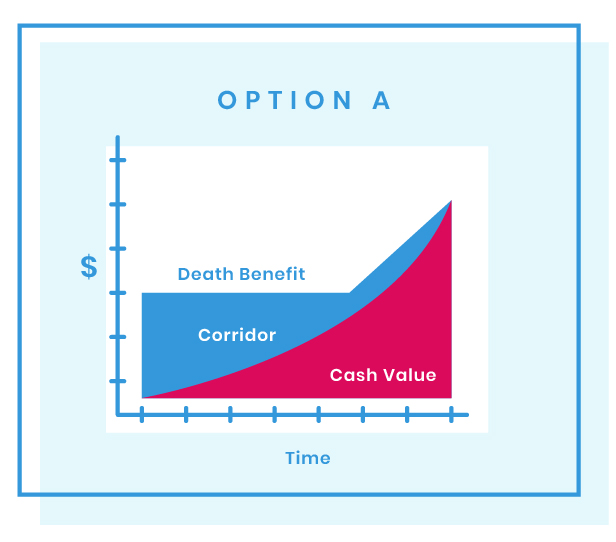

These permanent policies contain a death benefit or face amount which is the amount paid at the time of death and a cash value that grows over time on a tax-deferred basis similar to retirement or tuition savings plans.

. Variable life insurance A life insurance producer needs to possess a securities license to sell variable annuities 8. Hi Kathryn what you are saying would be true for a whole life insurance policy. See how variable life insurance policies compare to whole life insurance and variable annuities.

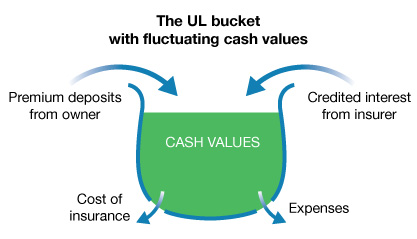

The Hartfords Life insurance also provides other services to an employee and their family like will preparation funeral planning travel assistance and more. While some other variable life insurance plans out there may include things like hidden fees and built-in agent commissions GVUL doesnt. If interest remains low the side fund may be depleted and the insured will have to increase premiums accordingly or reduce the face amount of the policy.

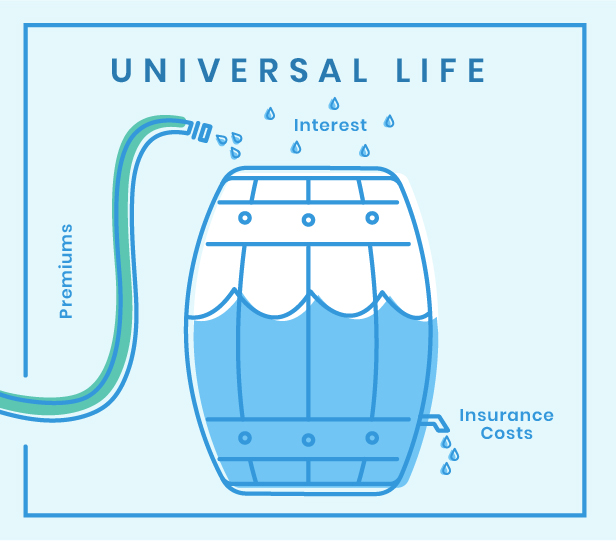

Premiums can be level or vary depending on the policy. Life Insurance coverage is up to age 100 as long as you maintain your membership. Universal Life Insurance.

Made up of three interlocking parts with the following exceptions. Permanent life insurance can be broken down into three types. What Is Variable Life Insurance.

Maximum and minimum premiums are set but you can pay any amount between these. There are multiple types of permanent life insurance including whole life universal life and variable life insurance. It also has a cash value that varies according to the amount of.

In a VUL the cash value can be invested in a wide variety of separate accounts similar to mutual funds and the choice of which of the available separate accounts to use is entirely up to the contract ownerThe variable component in the name refers to this ability to invest in. Some permanent life insurance policies offer two features. I believe what has happened is your death.

Variable Universal Life - combines the flexible premium features of universal life with the component of variable life in which excess credited to the cash value of the account depends on investment results of. Whole Life Insurance Form ICC17 8678 1-17 Form 8678 1-17 XX EZ Whole Life Insurance Form ICC17 8679 1-17 Form 8679 1-17 XX Term Life Form ICC16 8648 1-16 Form 8648 1-16 XX Family Term Life Insurance ICC16 8083 R-1-16 8063 R-1-16 XX. Face amount plus cash value - This type of policy will cost more but your beneficiaries will receive your cash.

Life insurance allows a family to help maintain its standard of living by providing income-tax-free money to help pay for funeral expenses pay off the mortgage set aside college tuition for the kids and help provide financial peace of mind after the loss of a loved one. Term life insurance simply covers you for a specified amount of time 10 20 and 30 year policies being the most common. The 7-pay test is used to determine the minimum death benefit of the policy D.

This means you wont have to sacrifice protection for your family if your financial health changes. Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. Grows based upon performance of the market though theres a guaranteed minimum annual return.

A whole life policy essentially has two values. Universal life insurance is known for its flexibilitythe policy allows you to adjust your premium payments within limits and death benefit amount depending on your needs. A securities license is required for a life insurance producer to sell variable life insurance.

Life insurance amounts can range from a flat dollar amount to multiples of an employees salary eg 3x the salary. Variable Life Insurance VLI 61983 121991 VLI is a variable whole life contract that had a minimum face amount of 25000. It was issued by Pruco Life Insurance Company and Pruco Life Insurance Company of New Jersey in NY and NJ.

The form number located in the lower left-hand corner of your contract is VL-83 and may be followed. The face value or death benefit and the cash value that acts as a savings account. A variable life insurance policy is a contract between you and an insurance company.

Whole life policies will pay the face amount of the contract upon death. As such they are more common with. Once the money invested increases the amount of.

A type of life insurance policy which provides for the payment of the face amount at the end of the specified period if the. Variable life insurance companies offer a variety of available investment. Variable Life is much more complicated.

Variable universal life insurance often shortened to VUL is a type of life insurance that builds a cash value. Variable life insurance also called variable appreciable life insurance provides lifelong coverage as well as a cash value account. While similar to variable life in that you can choose from a variety of investment options there is no guarantee beyond the original face value death benefit.

Exceeds the maximum amount of premium that can be paid into a policy and still have it recognized as a life insurance contract C. Variable Life Insurance - life insurance whose face value andor duration varies depending upon the value of underlying securities. Cash value an additional feature that might make your.

Universal whole and variable. Falls below the minimum amount of premium that can be paid into a policy and still have it recognized as a life insurance contract B. There are two main types of life insurance term life insurance and permanent life insurance.

Fidelity Life stands out for offering life insurance specifically geared towards people over 60 with term life whole life guaranteed issue plans and final expense insurance. Term life insurance has a set timeframe usually 10 to 30 years making it a more affordable option. The cash value would be paid if the policy was surrendered while the insured person was still alive.

Riders are a way of adding extra coverage or. Permanent life insurance policies are life-long and have cash value that increases over time. You can also pay premiums by using the policys cash value.

It is a policy that pays a specified amount to your family or others your beneficiaries upon your death. Like other life insurance policies including whole life insurance and term life insurance you can add a variety of riders to universal life policies. Death benefit the amount thats paid out to beneficiaries when the insured person passes awayThis is often referred to as the face value of your policy or the amount of life insurance coverage you purchased for example a 500000 whole life insurance policy.

Endorsed by the AICPA its coverage you can rely on. The face value of a life insurance policy is the death benefit while its cash value is the amount that would be paid if the policyholder opts to surrender the policy early. Depending on the contract other events such as terminal illness or critical illness can.

Permanent life insurance differs in that it lasts your entire lifetime. Life insurance can help protect your family members when they suffer the loss of a breadwinner or stay-at-home parent.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

Life Insurance Policy Loans Tax Rules And Risks

Life Insurance Loans A Risky Way To Bank On Yourself

Top 10 Pros And Cons Of Variable Universal Life Insurance

Life Insurance Infographics Contact Our Team Of Experts A 1 800 366 2751 For The Best Life Pol Life And Health Insurance Life Insurance Life Insurance Policy

12 Factors That Determine Your Life Insurance Premium Mymoneysage Blog

Universal Life Insurance Pros And Cons Termlife2go

:max_bytes(150000):strip_icc()/lifeinsurance-v32-8e01fd19793a49699e47973cfdf98f3d.png)

Life Insurance Guide To Policies And Companies

Division Of Financial Regulation Universal Life Premium Life Insurance And Annuities State Of Oregon

Best Cheap Life Insurance Get The Rates That Meet Your Budget Life Insurance Types Life Insurance Companies Variable Life Insurance

Universal Life Insurance Pros And Cons Termlife2go

Types Of Life Insurance Universal Life Insurance Life Insurance Quotes Term Life

What Is Whole Life Insurance Cost Types Faqs

Variable Life Insurance Policygenius

Variable Life Insurance Definition

Variable Life Insurance Is Based On What Kind Of Premium Insurance Noon

Life Insurance Converage Life Insurance Quotes Life And Health Insurance Life Insurance Marketing Ideas